What’s a Trading Tournament and Why You Need To Join One?

BullRush tournaments are a fun and interactive series of trading competitions to determine who is the best trader.

Most of us have taken part in a trading competition where somebody catches a lucky trade and returns a massive 100% return. This allows them to either win the competition or place high. The trader was only able to achieve this because they were participating in a single round competition, where the person with the highest % return wins.

If that same person had to achieve those results multiple times before they were crowned the winner, then it would be far less likely due to the fact they just got lucky. BullRush’s goal is to find the best traders around the world. To achieve this, we have developed the first every automated multi-round tournament to crown our winners.

BullRush Trading Tournaments take a page from sporting events such as World Cup Soccer or the Olympic 100-meter dash. Tournaments are multi-round competitions, where the traders from each group progress through the rounds until a winner is crowned.

BullRush tournaments can be anywhere from 2 – 12 rounds, with round 1 having anywhere from 2 – 25 groups.

Let’s break that down.

Table of Contents

What are trading tournament rounds?

Rounds are individual competitions that determine which participants progress to the championship, and ultimately crowned the winner. They are used to narrow the participants by finding the best and most consistent traders.

What are trading groups?

Groups are a way to divide participants into smaller sums of participants so that not everyone is competing against each other at the same time. These participants only compete against other participants in their group.

Let’s use the Olympics 100 Meter Dash as an example to explain how everything works.

The 100-meter dash in the Olympics allows for 56 participants from around the world to compete to find the fastest person in the world. It would be impossible to have all these runners compete against each other at the same time as a track does not have 56 lanes. A track has 9 lanes.

So, the 56 participants are divided evenly into 7 groups based on their fastest 100-meter dash for the year. This is deemed as the first round, or prelims as they refer to it in track and field. The top 3 finishers in each group, regardless of time, pass onto the next round.

This is the same as in a BullRush tournament.

In a BullRush tournament 3rd place in 1 group could return 10% and make it to the next round, while a trader in another group might return 20%, but place 10th. Even though that person earned a higher % return they would not qualify for the next round as they did not place in the top 3 of their group.

How to get started with trading tournaments?

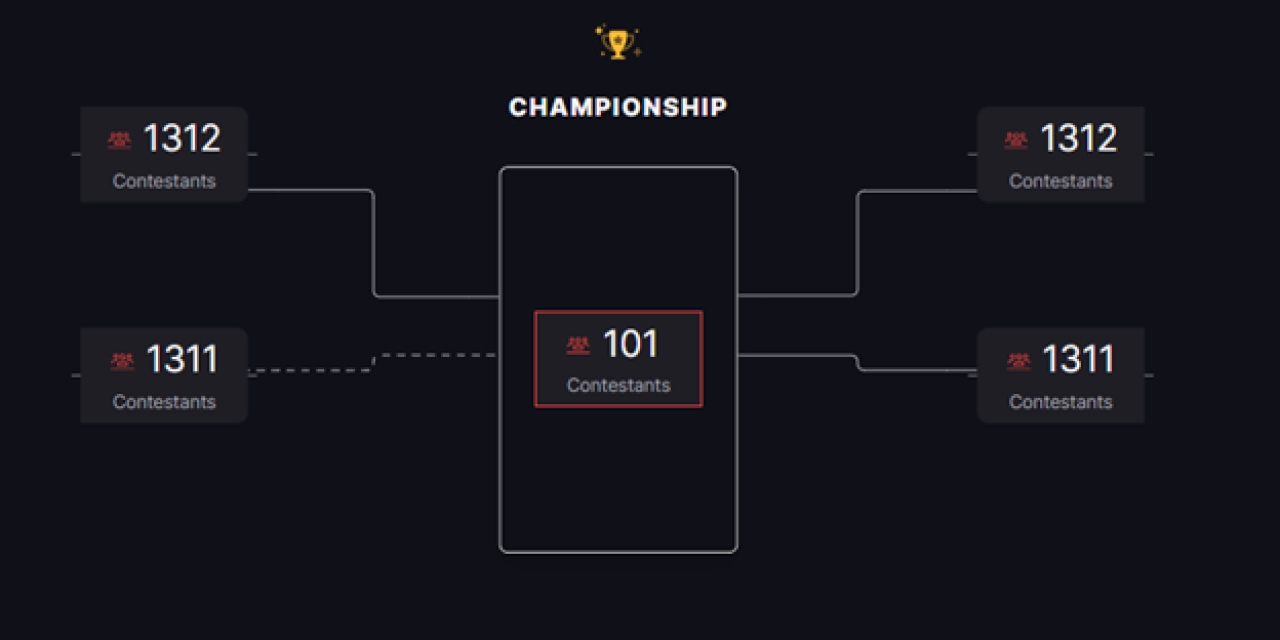

BullRush hosted its first ever tournament, Trading Freedom, in July. In this tournament there were 5,246 participants who registered. The tournament was broken into 2 rounds, with Round 1 consisting of 4 groups.

During the weeklong round one competition traders competed against each other in their respective groups. The top 25 participants from each group advanced to the Championship round.

In the championship round those 100 traders competed against each other to crown the first ever BullRush Tournament Champion.

Our next free tournament starts Aug 01 and ends just as the 2024 Olympics games on Aug 12th so don’t miss the chance to participate in a tournament completely for free.

Register for FREE at BullRush.Tech