Understanding Drawdown Limits in Trading Competitions

Drawdown Limits in trading competitions are usually different than limit calculations used for real trading in self funded or managed accounts. We are comparing the terms in the article below and giving you the right tips to understanding what is a drawdown in trading. Then using that information to have a competition advantage during a trading competition.

Imagine you’re entering a marathon, where the main goal isn’t just to finish first, but also to do so without exhausting all your energy—or, in a worst-case scenario, not to collapse before the finish line.

In the world of trading competitions, “Drawdown Limits” serve a similar purpose. They’re like safety nets designed to prevent traders (participants) from losing too much money too quickly. Additionally, they promote a more fair competition by limiting the ability for traders to ‘YOLO’ or gamble during the competition.

Let’s talk about drawdown limits and how to avoid getting kicked out of trading competitions too early.

Inside The Article

What is a Drawdown in Trading?

Drawdown can hold different meanings depending on who is doing the calculation. In a standard managed account or self directed account it means the maximum the account has lost from its peak-to-trough.

In simpler terms, it’s the percentage of loss that an account suffers from its peak to its lowest point before it starts winning again.

Imagine you start trading with $10,000, and at some point, your account value goes down to $7,000 before it starts rising again.

Your drawdown in this case is 30% because you lost 30% of your account value from its peak.

In reality, drawdown measures the risks you take with investments. To calculate Maximum Drawdown (MDD) you can follow the instructions given by Investopedia.

Drawdown Limits in Trading Competitions

Limits are set to cap the amount of loss a trader can incur during the competition.

It is one of the competition rules that aims to protect the integrity of the competition. Without limits some traders will treat the competition as a lottery ticket.

Instead of trading the same way they would in a ‘self-directed’ account, they instead take higher than normal risk with the trades.

Limits help to reduce the ability for traders to just ‘try it’, which promotes a more fair and honest competition for all competitors.

The most common types of drawdown limits in competitions are: DAILY and MAX

DAILY DRAWDOWN is based on the end-of-day balance to next day’s equity.

So, if you start a competition with $100K in equity and the daily drawdown is 5%.

That day you would be able to lose $5K (5% of starting balance).

If your account equity reached $95,000 you would be disqualified on ‘DAILY’.

Let’s say the following day your account reaches $200K in equity, then the next daily drawdown limit is 5% x $200K = $10K or if your equity goes below $190K you are disqualified (DQ).

MAX DRAWDOWN is set as a fixed amount based on starting balance.

So, if starting balance is $100K and max drawdown is 10%. If the account ever goes to $90k it breaches based on max drawdown.

Trailing vs Static Limits

In trading competitions, drawdown limits can can be set as ‘trailing’ or ‘static’.

TRAILING LIMIT is calculated based on the highest balance while STATIC LIMIT is set based on the starting balance and remains the same amount throughout the competition.

Why Are Drawdown Limits Important?

Risk Management

They encourage traders to adopt sound risk management practices, ensuring they don’t take reckless risks in pursuit of high returns.

Level Playing Field

Limits ensure that the competition remains fair, preventing participants from winning through sheer luck or extremely risky trades.

Afterall, trading competitions are a game of skill and requires deep understanding of the markets.

Learning Experience

For novice traders, adhering to drawdown limits is an excellent practice in managing losses and understanding the importance of preserving capital.

In essence, drawdown limits are there to make sure that while you’re trying to win the race (trading competition), you don’t run out of steam (funds) by taking too much risk. It teaches the importance of balance between pursuing gains and managing losses, a crucial lesson for any trader, but especially for someone just starting out.

The Significance of Drawdown Limits

One of the key reasons why drawdown limits are significant is that they help protect traders from catastrophic losses.

In volatile markets, it is not uncommon for traders to experience drawdowns, which occur when the value of their portfolio or trading account declines from its peak.

By imposing drawdown limits, trading competitions ensure that traders do not risk losing all their capital in a single trade or a series of unfavorable trades.

Furthermore, drawdown limits also promote disciplined trading. Traders are forced to closely monitor their performance and adjust their strategies accordingly to stay within the limits.

This encourages traders to be more cautious and thoughtful in their decision-making process, ultimately leading to better risk management and more consistent performance.

In summary, drawdown limits are significant in trading competitions as they protect traders from excessive losses, promote disciplined trading, and encourage responsible risk management.

Factors Influencing Drawdown Limits

Several factors can influence the drawdown limits set in trading competitions. These factors may vary depending on the specific competition and its objectives. Here are some common factors to consider:

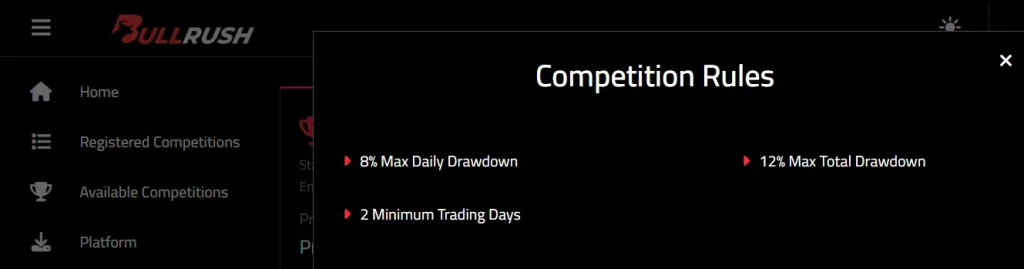

Competition Rules

The organizers of the trading competition have the authority to determine the drawdown limits. They may consider factors such as the duration of the competition, the trading instruments allowed, and the risk tolerance of the participants.

Most trading competitions will have a Drawdown Limit, which if reached will disqualify you from the competition.

In general, the lower the DL, the harder the competition standards.

Market Volatility

The level of market volatility can have a significant impact on drawdown limits. In highly volatile markets, the drawdown limits may be set more conservatively to account for the increased risk of large losses.

Participant Experience

The experience and skill level of the participants can also influence drawdown limits. Beginners may have lower drawdown limits to ensure they do not take excessive risks, while experienced traders may have higher limits based on their track record.

Financial Resources

The financial resources available to participants can also play a role in setting drawdown limits. Participants with larger trading accounts or access to additional capital may have higher drawdown limits compared to those with limited resources.

It is important for participants to understand the factors influencing drawdown limits in order to devise appropriate trading strategies and manage their risk effectively.

Join BullRush News:

Trading Strategies to Manage Drawdown

Managing drawdown is a critical aspect of trading competitions. Here are some strategies that can help participants effectively manage:

DIVERSIFICATION: Diversifying the trading portfolio across different asset classes, sectors, or trading strategies can help reduce the impact of drawdowns. By spreading the risk, participants can minimize the potential losses from any single trade or investment.

RISK MANAGEMENT: Implementing proper risk management techniques, such as setting stop-loss orders, can help limit losses and prevent drawdowns from exceeding the predefined limits. Traders should determine their risk tolerance and adjust their position sizes accordingly.

REGULAR MONITORING: Monitoring the performance of the trading account on a regular basis is essential to identify potential drawdowns early. By closely monitoring the account, participants can take timely action to mitigate losses and prevent drawdowns from escalating.

ADJUSTING STRATEGIES: If drawdowns occur, participants should be willing to adjust their trading strategies. This may involve reducing position sizes, reassessing risk levels, or even temporarily pausing trading to reevaluate the market conditions. Flexibility and adaptability are key to managing drawdown effectively.

By implementing these strategies, participants can better manage drawdowns and improve their overall trading performance in the competition.

Impact of Drawdown Limits on Trading Performance

Limits can have a significant impact on trading performance in competitions. Here are some key ways they can affect participants:

Risk Profile

Limits force participants to prioritize risk management. By adhering to the limits, participants are encouraged to be more cautious and selective in their trading decisions. This can lead to better risk-adjusted returns and overall improved trading performance.

Emotional Control

Drawdown limits can help participants maintain emotional control during periods of market volatility. Knowing that there is a limit to the potential loss can prevent panic selling or impulsive trading decisions. This allows participants to stick to their trading strategies and avoid making irrational decisions based on short-term market fluctuations.

Consistency

They promote consistency in trading performance. Participants are incentivized to maintain a consistent level of performance without taking excessive risks. This can lead to more stable and predictable returns over the course of the competition.

Learning Opportunity

They are also a valuable learning opportunity. By analyzing the causes and consequences of drawdowns, participants can identify areas for improvement in their trading strategies and risk management techniques.

This feedback loop can help participants refine their skills and become better traders in the long run.

Tips for Adhering to Drawdown Limits

1. Set Realistic Goals: Establish realistic day trading goals that align with your risk tolerance and available resources. Avoid setting overly ambitious targets that may lead to excessive risks and potential drawdowns.

2. Follow a Trading Plan: Develop a comprehensive trading plan that outlines your strategies, risk management techniques, and drawdown limits. Stick to the plan and avoid deviating from it based on short-term market fluctuations or emotional impulses.

3. Regularly Review Performance: Regularly review and analyze your trading performance to identify any potential drawdowns or deviations from your plan. This will allow you to make timely adjustments and prevent drawdowns from exceeding the predefined limits.

4. Seek Professional Advice: Consider seeking guidance from experienced traders or financial advisors who can provide valuable insights and help you navigate through challenging market conditions. Their expertise can assist you in managing drawdowns effectively.

By following these tips, you can increase the chances of adhering to drawdown limits and maintaining a competitive edge in trading competitions.

Leave a Reply

You must be logged in to post a comment.