Dynamic Leverage in Trading Competitions

Equal opportunity does not mean equal outcome in leverage trading. But everyone should have an equal opportunity to succeed, especially when it comes to trading competitions.

What often occurs is that trading competitions attract participants who trade a wide range of products. Some of those products, such as Bitcoin are extremely volatile. While the S&P500 is much more stable.

Table of Contents

What’s Leverage Trading or Margin Trading?

This is one of those trading terms that you really need to know in order to trade at the highest level. Investopedia defines it as ‘Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency.’

Leverage in Trading Competitions

How most firms operate their trading competitions is that they set all products to have the same leverage, regardless of the products volatility. This creates an unfair advantage for the person who focuses on the higher volatility products. The person trading the S&P500 by the very nature of leverage has far fewer opportunities to succeed in a trading competition.

This is why most competitions are won by people trading bitcoin, gold, or other highly volatile products.

Enter a revolutionary concept! Dynamic Leverage!

Dynamic Leverage in Trading Competitions

To create a fair environment where everyone has equal opportunity BullRush has introduced dynamic leverage. We achieve this by aligning margin rates with the underlying market volatility. Prior to a competition start we run an algorithm that takes into consideration the daily volatility, VAR (Value at Risk), and ATR (Average True Range). Based on this algorithm we set the margin for each product so that if a client opened a max position in any product and left it for the entire day, they would have the potential to earn the same amount of money, regardless of product.

What does this mean as a trader?

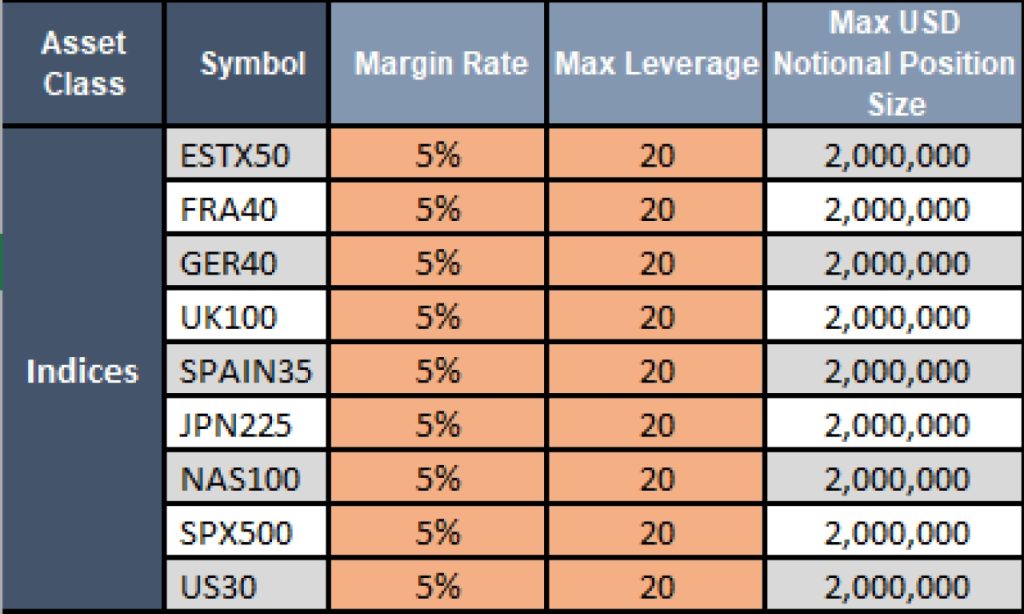

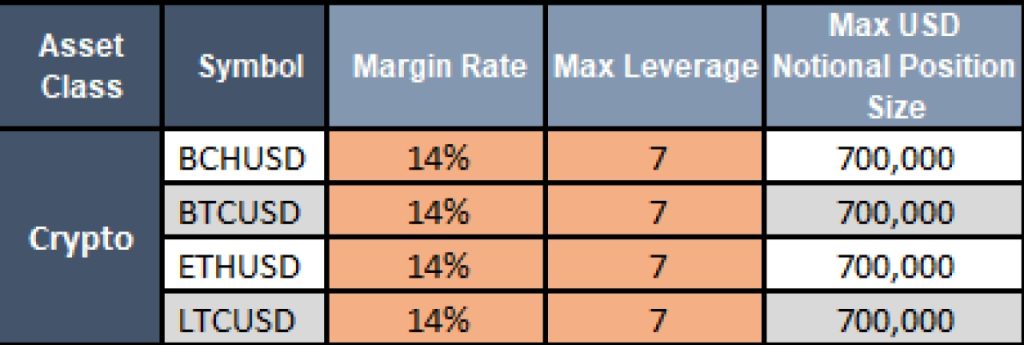

Using the Bitcoin and S&P500 example above it means that Bitcoin has a margin requirement of 14% (7:1 leverage), while the S&P500 as a margin requirement of 5% (20:1 leverage).

Based on the algorithm, if you have two traders with two accounts each trader has an equal opportunity to make the same amount of money on any given day. If at the start of a day Trader 1 places their maximum trade size in the S&P500. And, Trader 2 places their maximum trade size in Bitcoin, based on the market volatility they each have the opportunity to make the same amount of money on average.

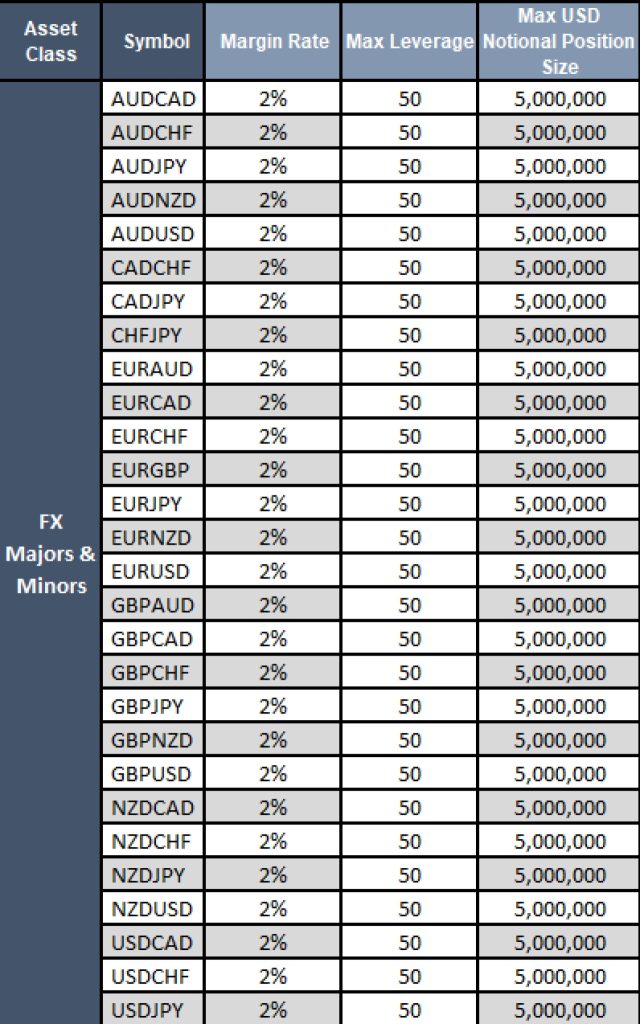

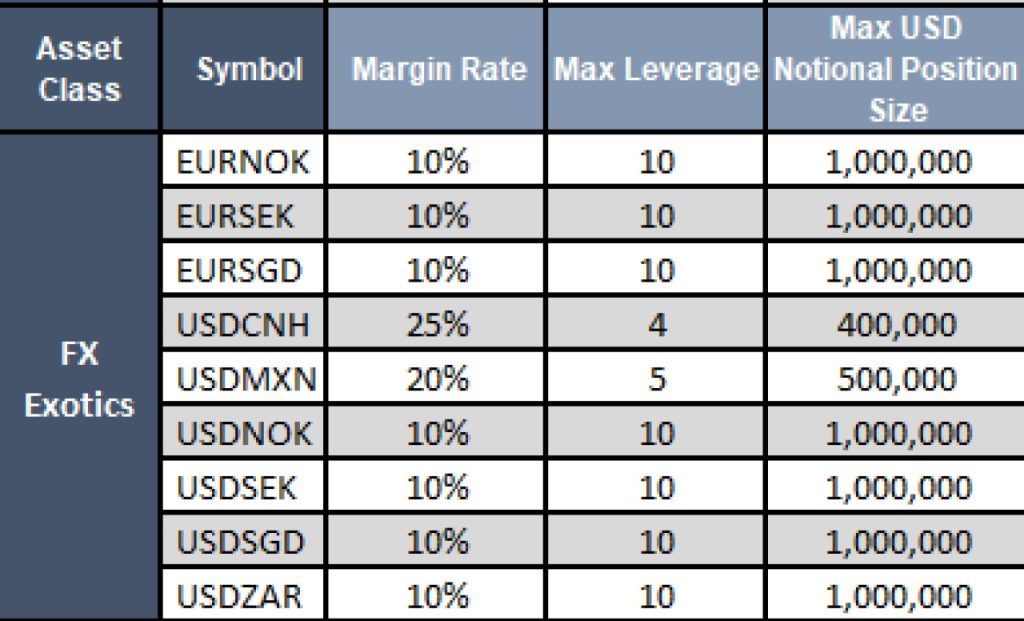

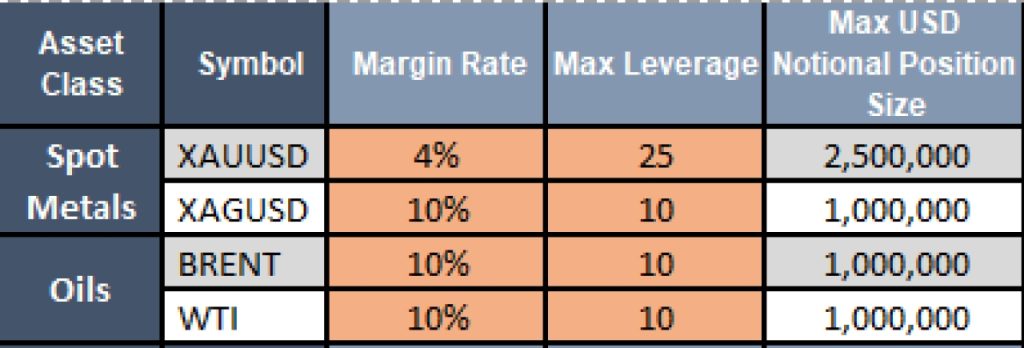

For our Freedom Tournament the margins have been set to the below for each product:

Experience Dynamic Leverage in Action

Inside the Freedom Tournament you can experience dynamic leverage. Sign up for the tournament and other competitions here.